Updated June 10, 2024

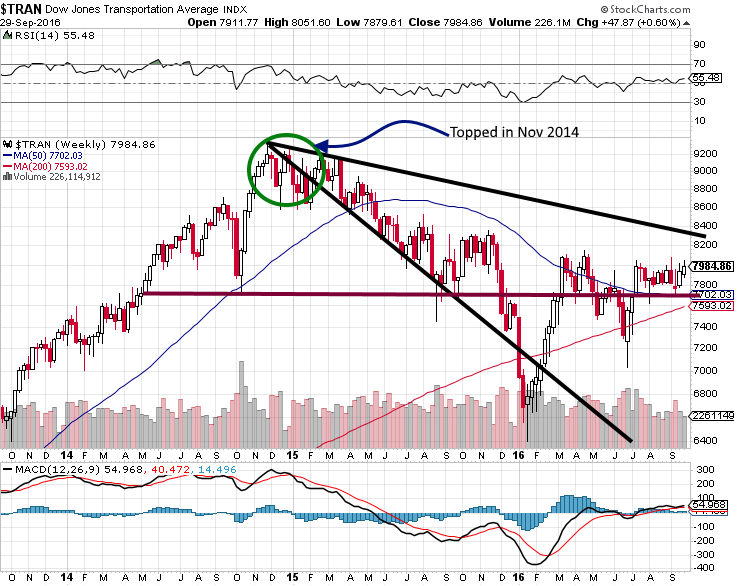

The transport topped out in November of 2014, and according to the Dow theory, this is a big negative; the Dow Industrials should have followed suit. Instead, the Dow soared higher, paying no heed to this theory, proving to a large degree that this argument has lost its value. After all, it is a theory, and the definition of a theory is “a supposition or a system of ideas intended to explain something, especially one based on general principles independent of the thing to be explained.”

As early as 2006 we offered an Alternative Dow Theory that has proved far more accurate and reliable than the original Dow theory. Just to let this sink in, the transport topped out almost two years ago, and instead of trending lower, the markets have surged to new highs. If you look at the above chart, the Transports appear to be finally gathering momentum and breaking out. In the Dow theory alternative, we stated it was the Utilities that lead the way as opposed to the Dow transports, well let’s see if that holds true. We are using older charts to fully illustrate the power behind this alternative theory.

The Alternative Dow Theory Has A Better Track Record than its predecessor.

In the chart above, the utilities pulled back after the Dow transports, let out some steam and then soared to new highs. Even though the correction appeared strong, the Dow utilities held above the main uptrend line. It is all but obvious that the Dow utilities are a better barometer of what one should expect from the markets. The Utilities topped in Feb of 2015, and after that, the Dow trended sideways before correcting, illustrating that they follow the lead of the Utilities and not the Dow transports.

The Dow utilities bottomed towards the end of August 2015 and rallied until November 2015 before pulling back again. The Dow followed in the utilities’ footsteps. It bottomed in January 2016, while the utilities bottomed in December 2015, once again leading the way. The Dow utilities rallied until July 2016 before pulling back.

The Dow rallied until Aug of 2016, proving again that the utilities are a better indicator of market direction than the Dow transports. At this point, the utilities are building momentum to take off again. If the pattern holds, then the Dow should follow in its path.

How are the Dow Industrials and Dow Transports faring in 2017?

Well, as you can see the transports took off like a rocket after September 2016 and have not looked back since. The picture of the Dow industrials is almost identical to that of the Dow Transports.

Once again, we have clear evidence illustrating that the Dow utilities provide a much clearer picture of where the Dow is heading than the Dow Transports.

Out with the Old Dow Theory and In with the New Dow Theory

The Dow utilities and the Dow industrials traded to new highs; this means that rather than leading the way up, the Dow transports propel individuals to draw the wrong conclusion. The Dow Theory ceased to work properly a long time ago, and in the era of hot money, it is having a hard time trying to be relevant. The alternate Dow Theory that focuses on the utilities is a better option. Thus, maybe it is time to put this 100-year-old theory to rest; we will let you be the judge.

Paying attention to what the utilities are doing in the future could be rewarding. Once the Dow utilities start to trend upwards, it should serve as a strong signal that the Dow will follow in its path. Applying the principles of Mass psychology and Contrarian investing, we could confidently state that the experts were wrong when they said this market would crash in 2014, 2015, 2016, and 2017. We repeatedly went on record to the state that this Stock Market Bull would trade to heights that would shock everyone.

Published courtesy of the Tactical Investor

Scholarly Escapades: Exceptional Reads for the Curious

Is withholding information manipulation?

How do I know my socioeconomic status?

How did the stock market panic 2020 reshape investor strategies?

Could the stock market panic of 1907 happen again?

How does the stock market trend after election affect investments?

How did the GameStop saga of 2021 reshape the stock market?